in caricamento ...

La FED teme la TRUMPONOMICS. Ma che dire della GUERRA COMMECIALE in arrivo?

Quanto è risultato dal Minute FED non va certo a sconvolgerci la vita in quanto era tutto ampiamente previsto e prevedibile, vuoi perchè ormai conosciamo bene la Yellen e vuoi perchè, come detto, il mercato stava già scontando tutto.

Forse la parola che più di tutte merita attenzione, però, in questo Minute FED è “incertezza”.

E l’elemento che più di tutti causa incertezza è proprio il neo eletto presidente degli USA Donald Trump, che salirà alla Casa Bianca tra un paio di settimane in modo ufficiale.

(…) La Federal Reserve ha pubblicato i verbali della riunione dello scorso dicembre, durante la quale i suoi membri hanno parlato di “incertezze notevoli” legate alle politiche fiscali espansive promesse dal presidente eletto Donald Trump. Il rischio è che la banca centrale Usa sia costretta ad alzare i tassi più rapidamente del previsto se la nuova amministrazione e il congresso approveranno tagli alle tasse e progetti infrastrutturali pensati per spingere la crescita. Tuttavia, è ancora “troppo presto” per giudicare l’impatto delle iniziative di Trump (che nel documento non è mai stato citato esplicitamente) e attualmente il mercato non crede che la Fed sia pronta a una stretta nell’immediato. (Rep)

Nel Minute FED quindi c’è un po’ di timore per il futuro ma attenzione, c’è anche una forte ammissione. Se Trump fa quello che dice, avremo sicuramente più inflazione e la FED dovrà intervenire prima del previsto. Se però questo accade, significa anche che Trump butterà tanta benzina sul fuoco, incendiando sopratutto le ASPETTATIVE (prima ancora del resto) di forte crescita economica.

Ed ecco quindi “giustificato” l’ennesimo attacco ai massimi di Wall Street e nella fattispecie sto parlando del Dow Jones, nuovamente ad un passo dalla soglia psicologica di 20.000 punti.

Dow Jones: grafico daily

Io sono convinto del fatto che Trump porterà sicuramente linfa vitale ai mercati finanziari. Però cerchiamo di lasciare da parte, per un attimo, gli effetti psicologici della venuta del Messia Trump (il mercato si sta muovendo esclusivamente su aspettative, non dimentichiamoci) e cerchiamo di essere realisti.

I 20.000 punti (quasi) del Dow Jones sono figli delle linee di espansione fiscale proposte dal neo eletto Presidente. La bomba dei tagli di tasse per le imprese e gli investimenti in infrastrutture stanno facendo la differenza. Ma qualcuno ha provato a considerare l’impatto teoricamente “devastante” che Trump vorrà dare al commercio?

https://www.youtube.com/watch?v=Twemlmoijp0

Ecco come la pensa l’autorevole PIIE (Peterson Institute for International Economics): parere autorevole e decisamente controcorrente in quanto va “oltre” a quelle che sono le apparenze del momento, anche forse ha una visione fin troppo critica.

Republican candidate Donald J. Trump’s sweeping proposals on international trade, if implemented, could unleash a trade war that would plunge the US economy into recession and cost more than 4 million private sector American jobs, according to an empirical analysis of the two candidates’ trade agendas by the Peterson Institute for International Economics. Trump has proclaimed that he would “rip up” existing trade agreements, renegotiate the North American Free Trade Agreement (NAFTA), and impose a 35 percent tariff on imports from Mexico and a 45 percent tariff on imports from China. Hillary Clinton, the Democratic candidate, has expressed skepticism about trade but in effect represents stasis. Both candidates have come out against the Trans-Pacific Partnership (TPP) between the United States and 11 Pacific Rim countries, which President Barack Obama signed earlier in 2016. (PIIE)

Qui si parla di una vera e propria “guerra commerciale” che addirittura porterebbe gli USA in recessione (e chi parla oggi di recessione?) con la perdita di 4 milioni di posti di lavoro. IL tagli o degli accordi col NAFTA, le imposizioni di dazi pari al 35% col Messico e del 45% con la Cina, SE effettivamente realizzati, sarebbero un boomerang devastante per l’economia USA.

E questo è solo uno dei tanti punti controversi del piano Trump. Ricordate, il mercato sta guardando SOLO un lato della medaglia, ma ci sono tanti punti oscuri e tanti tasselli del programma che sono in contrasto.

Non prendo per oro colato quanto detto da PIIE, ma forse quanto scritto vi conferma che il mercato, in questo momento, sta sovrastimando l’impatto positivo della TRumponomics.

Riproduzione riservata

STAY TUNED!

(Clicca qui per ulteriori dettagli)

Segui @intermarketblog

Questo post non è da considerare come un’offerta o una sollecitazione all’acquisto. Informati presso il tuo consulente di fiducia. NB: Attenzione! Leggi il disclaimer (a scanso di equivoci!)

(Se trovi interessante i contenuti di questo articolo, condividilo ai tuoi amici, clicca sulle icone sottostanti, sosterrai lo sviluppo di I&M!)

-[1]- … “The Directors of one Reserve Bank recommended that the primary credit rate be maintained at its current level of 1%. These Directors concluded that it would be appropriate to maintain an accommodative stance of Monetary Policy to support continued strengthening of the labor market and the return of inflation to the Federal Reserve’s 2% objective” …

– l –

-[2]- … “At its meeting on December 12, the Board had considered, but had taken no action on, the requests to increase the primary credit rate.

At today’s meeting, there was consensus for a 25-basis-point increase, and the Board approved an increase in the primary credit rate from 1% to 1-1/4%, effective December 15, 2016, for the Federal Reserve Banks of Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Kansas City, Dallas and San Francisco.

This vote of the Board also encompassed approval of the renewal by all 12 Reserve Banks of the existing formulas for calculating the rates applicable to discounts and advances under the secondary and seasonal credit programs.

As specified by the formula for the secondary credit rate, the secondary credit rate would be set 50 basis points above the primary credit rate. And as specified by the formula for the seasonal credit rate, the seasonal credit rate would continue to be reset every two weeks as the average of the daily effective Federal Funds Rate and the rate on three-month CDs over the previous 14 days, rounded to the nearest 5 basis points” …

l- – – – –

§- Federal Reserve Board [(FRB), Office of the Secretary memorandum, (and), Press Release, the], “Minutes of the Board’s discount rate meetings from November 14 through December 14, 2016” – Washington D.C.: January 10, 2017

https://www.federalreserve.gov/newsevents/press/monetary/monetary20170110a1.pdf

– – – – -l

サーファー © Surfer

– l –

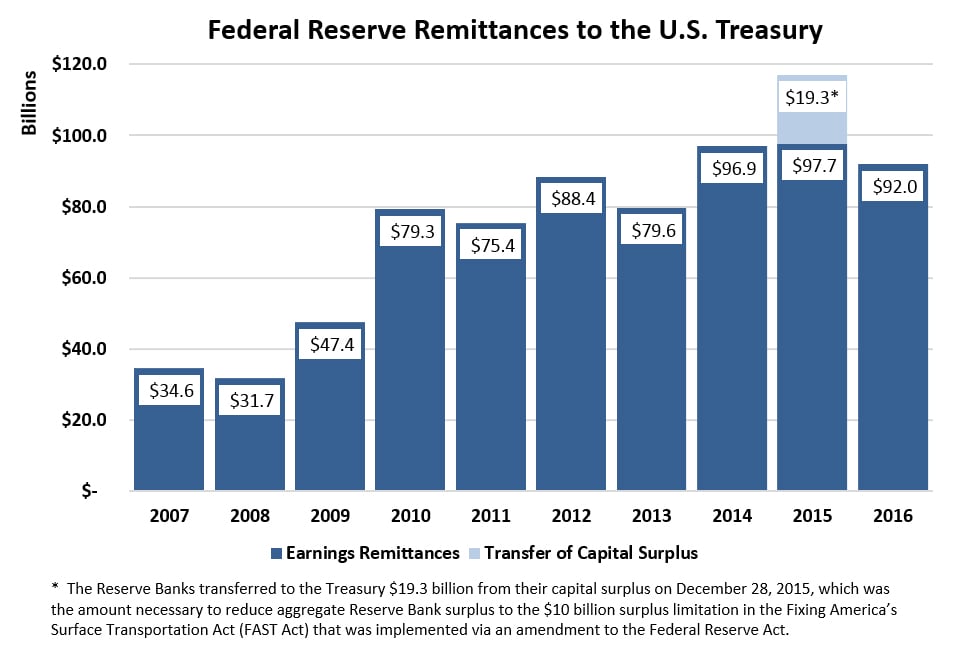

The Federal Reserve Banks’ 2016 estimated net income of USD$92.7 billion represents a decrease of USD$7.6 billion from 2015, primarily attributable to a decrease of USD$2.5 billion in interest income from changes as a result of the composition of Securities held in the Federal Reserve System Open Market Account (SOMA) and an increase of USD$5.2 billion in interest expense associated with reserve balances held by depository Institutions.

Net income for 2016 was derived primarily from USD$111.1 billion in interest income from Securities held in the SOMA [U.S. Treasury Securities, Federal Agency and Government Sponsored Enterprise (GSE) Mortgage-Backed Securities, and GSE debt Securities].

Operating expenses of the Reserve Banks, net of amounts reimbursed by the U.S. Treasury and other entities for services the Reserve Banks provided as fiscal agents, totaled USD$4 billion in 2016.

In addition, the Reserve Banks were assessed USD$700.7 million for the costs related to producing, issuing and retiring currency, USD$709 million for Board expenditures and USD$596.2 million to fund the operations of the Consumer Financial Protection Bureau.

The Reserve Banks had interest expense of USD$12.0 billion associated with reserve balances and term deposits held by depository Institutions and incurred interest expense of USD$1.1 billion on Securities sold under agreement to repurchase. Additional earnings were derived from income from services of USD$435 million.

Statutory dividends paid to Member Banks totaled USD$711.5 million in 2016.

No income was transferred to surplus due to the USD$10 billion aggregate surplus limitation as required by the Federal Reserve Act.

The attached chart illustrates the amount the Reserve Banks distributed to the U.S. Treasury from 2007 through 2016 (estimated).

l- – – – –

§- FRB (Press Release, the), “US Reserve Bank income and expense data and transfers to the Treasury for 2016” – Washington D.C.: January 10, 2017

https://www.federalreserve.gov/newsevents/press/other/20170110a.htm

– – – – -l

サーファー © Surfer

The Federal Reserve Banks’ 2016 estimated net income of USD$92.7 billion represents a decrease of USD$7.6 billion from 2015, primarily attributable to a decrease of USD$2.5 billion in interest income from changes as a result of the composition of Securities held in the Federal Reserve System Open Market Account (SOMA) and an increase of USD$5.2 billion in interest expense associated with reserve balances held by depository Institutions.

Net income for 2016 was derived primarily from USD$111.1 billion in interest income from Securities held in the SOMA [U.S. Treasury Securities, Federal Agency and Government Sponsored Enterprise (GSE) Mortgage-Backed Securities, and GSE debt Securities].

Operating expenses of the Reserve Banks, net of amounts reimbursed by the U.S. Treasury and other entities for services the Reserve Banks provided as fiscal agents, totaled USD$4 billion in 2016.

In addition, the Reserve Banks were assessed USD$700.7 million for the costs related to producing, issuing and retiring currency, USD$709 million for Board expenditures and USD$596.2 million to fund the operations of the Consumer Financial Protection Bureau.

The Reserve Banks had interest expense of USD$12.0 billion associated with reserve balances and term deposits held by depository Institutions and incurred interest expense of USD$1.1 billion on Securities sold under agreement to repurchase. Additional earnings were derived from income from services of USD$435 million.

Statutory dividends paid to Member Banks totaled USD$711.5 million in 2016. No income was transferred to surplus due to the USD$10 billion aggregate surplus limitation as required by the Federal Reserve Act.

The attached chart illustrates the amount the Reserve Banks distributed to the U.S. Treasury from 2007 through 2016 (estimated).

§- FRB (Press Release, the), “US Reserve Bank income and expense data and transfers to the Treasury for 2016” – Washington D.C.: January 10, 2017

https://www.federalreserve.gov/newsevents/press/other/20170110a.htm

サーファー © Surfer

certo!!!! c’è incertezza ma come ho commentato in precedenza (subito dopo le elezione USA): easy boy…. let’s wait and see.!!!!!