in caricamento ...

Mercato immobiliare: anche se fragile regge alla grande

Financial Web Links, un elenco di siti e link finanziari con un’analisi della situazione

Il mondo è bello perché è vario. E proprio perché è vario ci ritroviamo Wall Street che viene “salvata” dal settore immobiliare. Certo, il +10% è un buon dato. Ma a me vengono i brividi quando pernso al macigno che pesa sulla coscienza delle banche USA con la vicenda del pignoramenti truffaldini, il foreclosure fraud ribattezzato foreclosure gatre, in quanto fa a “toccare” moltissimi attori del mercato. Se riesco ve ne parlerò in modo più dettagliato. Intanto però la borsa continua la sua salita, pian pianino, verso i massimi. E il calendario pian pianino si sposta verso il FOMC…

Buona lettura e buona visione!

- Continua a salire la borsa USA (reuters)

- Chicago FED: l’attività economica ha di nuovo rallentato (CalcRisk)

- Ma le prospettive per la borsa sono per certi analisti ancora molto positive! (MoneyGame)

- Mercato immobiliare UK: i problemi non sono finiti (FT)

- Existing home Sales: il Sud torna alla riscossa! (TDI)

- MERS: ancora sui foreclosure fraud (BigP)

- Le elezioni di medio termine (Vix&M)

- Marc Faber: Print! Print! Print! (DR)

- Oro e argento? Non sono in bolla speculativa (Sprott)

- Vogliono fare saltare l’Euro? (ZH)

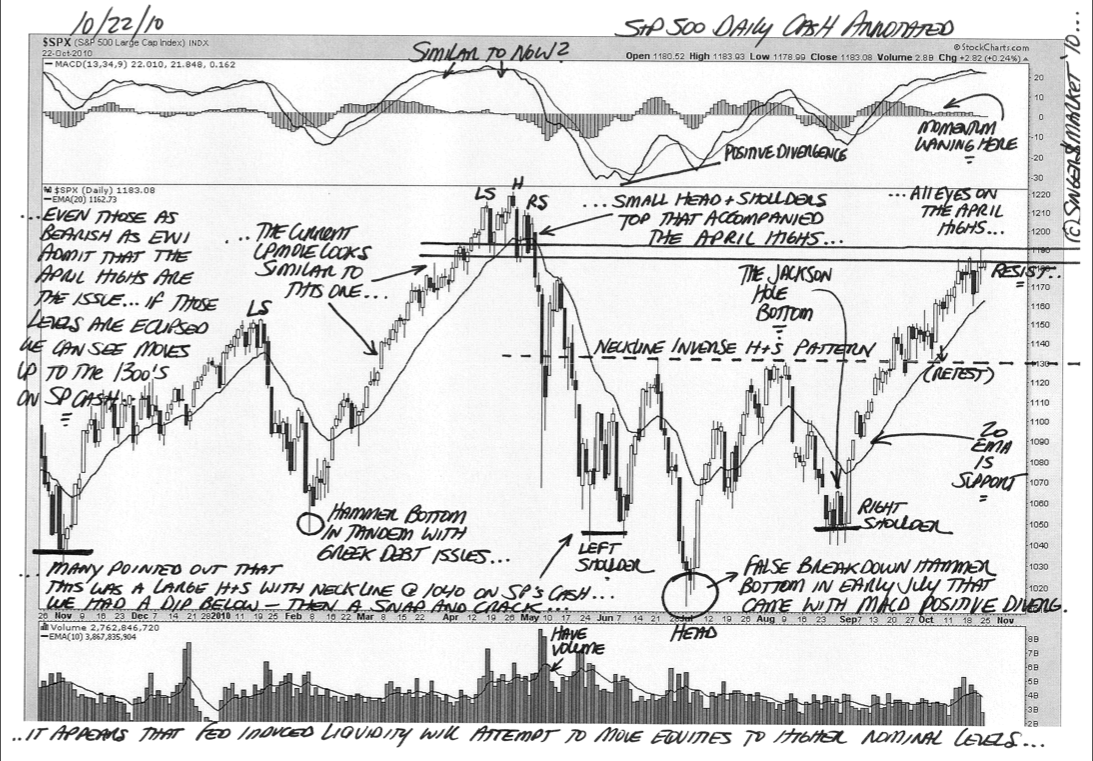

Un grafico alternativo dello SP 500

E voi, invece, cosa avete letto di interessante? Scrivetelo nei commenti!

Problemi con gli articoli in inglese? Inserite il link in questo traduttore!

Ovviamente siete tutti invitati non solo a commentare le notizie ma anche a inserire voi stessi link finanziari che possano essere utili alla comunità.

STAY TUNED!

DT

Tutti i diritti riservati ©

NB: Attenzione! Leggi il disclaimer (a scanso di equivoci!)

Sostieni I&M! Clicca sul bottone ”DONAZIONE” qui sotto o a fianco nella colonna di destra!

Vuoi provare il Vero Trading professionale? PROVALO GRATIS!

La recessione raggiunge la grande depressione:

http://economicsfreenews.blogspot.com/2010/10/this-recession-tops-great-depression.html

The economic jam we’re in has topped even the great depression in one respect. Never have we had a recession this deep with a recovery this flat. Unemployment has been at 9.5% or above for fourteen months. Congress did something that it’s never done before. It extended unemployment benefits for 99 weeks. That cost more than $100 billion, a huge expense for a government in debt. But now, for many Americans, 99 weeks have passed and there is still no job in sight.

Benvenuti nella terra promessa:

http://economicsfreenews.blogspot.com/2010/10/survival-guest-post-welcome-to-promised.html

A portion of the complete article Welcome to the Promised Land has been republished with copyright permission from James Rawles’ Survival Blog. It has been written and contributed to Survival Blog by Rod E.

Over the years, many people have told us that WTSHTF, they are coming to our place in the country. When people say things like this, we hear, “…so that you can take care of me.” This document is presented as a source of information for those who might need a realignment of their expectations, a clarification of ours or both. It should serve as a harsh wake up call for anyone who plans to flee to someone else’s survival retreat should the need arise

Articolo sugli “avvoltoi”:

http://economicsfreenews.blogspot.com/2010/10/how-gang-of-predatory-lenders-and-wall.html

How a Gang of Predatory Lenders and Wall Street Bankers Fleeced America–and Spawned a Global Crisis

I am in New York this afternoon attending and speaking at the Bank Credit Analyst Conference. I have to say that the panel on emerging markets gave me some real food for thought and an idea or two for a future e-letter. I have been a fan of emerging markets in general (with some exceptions) for some time but I should become even more so I think.

For today’s Outside the Box I have something a little different. Michael Hudson has written a book called The Monster about the Mortgage industry, and specifically Ameriquest and Lehman. Someone sent me his introduction and I read it on the plane. I will buy the book. It made me angry. And the new financial regulations don’t address some of the real problem here

Un po’ di vignette per ridere:

http://financenewsoftheworldbis.blogspot.com/2010/10/goldman-busters-banzai7-happy-halloween.html

concludo: Milioni di americani disoccupati vivono come mendicanti:

http://financenewsoftheworld.blogspot.com/2010/10/millions-of-unemployed-americans-now.html

Most Americans still do not understand just how bad the economic horror we are facing really is. Today, millions of Americans are living as paupers in the land that their foreathers built even as America’s infrastructure is literally being sold out from under their feet by corrupt politicians. The “official” unemployment rate in the United States has been at nine and a half percent or above for 14 consecutive months, and today it takes the average unemployed American about 35 weeks to find a job. However, the “official” unemployment rate is misleading, because it does not include workers that have quit looking for work or that have had their hours cut back to part-time. According to 60 Minutes, when you add those “discouraged workers” and “underemployed workers” into the equation the actual rate is about 17 percent, and in the state of California the actual rate is about 22 percent. Meanwhile, foreign nations are using sovereign wealth funds to buy up staggering amounts of U.S. infrastructure. America is quite literally for sale in 2010. All across the United States, highways, ports, toll roads and even parking meters are being gobbled up by foreign powers. We have shipped massive amounts of wealth and jobs to other nations, and now those very same countries are turning around and buying huge amounts of U.S. infrastructure with the gigantic piles of dollars that they have accumulated.

Io dt leggo questo sito e parlano solo di long

http://www.you-videolive.it/index.php?hash=7363f77ea6ca2566c4537131ff389ee8

chiaramente è un parare che da il tipo

cmq mq me lo voglio appendere in camera questa immagine è bellissima

http://icegergfinanza.splinder.com/post/23504389/nessuna-speranza-autunno-giapponese

commenti molto vicini ai nostri.

GB MEGLIO DELLE PREVISIONI: PIL +0.8% t/t (stima 0.4%) +2.8% a/a (stima 2.4%)

PROPRIO sul mkt immobiliare:

http://www.economist.com/node/17311841

Buon giorno, qualche links rima di uscire…:

iniziamo con una intervista “perche gli inside stanno vendendo…):

http://newsunderinvestigation.blogspot.com/2010/10/insiders-are-selling-what-does-it-mean.html

Insider selling has soared in recent weeks as insiders appear to be cashing in after the huge equity market rally. But it might not necessarily be bad news. Robert Maltbie, of Singular Research, and Jonathan Moreland, of InsiderInsights.com break down the data: